This article is adapted from Newcomer, a newsletter about technology and venture capital.

In any just world, Chamath Palihapitiya would be ashamed of himself.

The well-known venture capitalist and podcaster lent his reputation to a slew of companies going public via his special-purpose acquisition companies. He was the ruinous “SPAC King.”

Now, almost a year after calling it quits on two SPACs, he’s still in denial that he was the Pied Piper who enticed retail investors into betting on speculative, money-losing companies. He’s like a bully who stole someone’s lunch money and then says, “Stop crying about it”—except it’s for all the world to see.

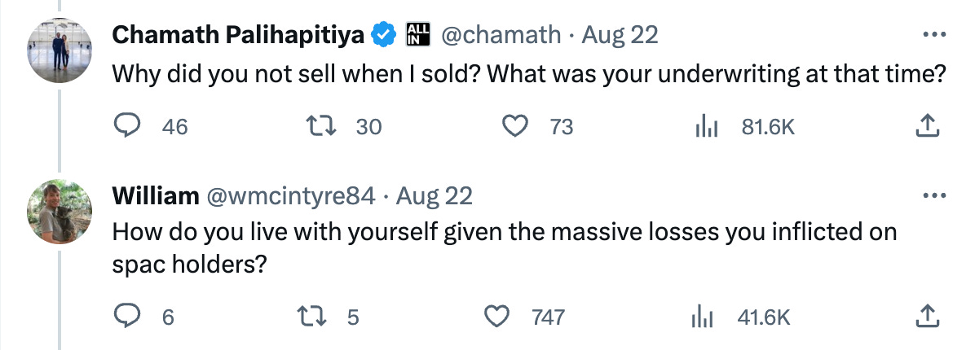

This week on X, Palihapitiya is dunking on people who say that they lost money because of him.

He has said he made roughly $750 million by throwing his reputation behind the stocks, taking them public via SPACs that he helmed, then selling shares on the public markets. He hyped the stocks, he sold his shares, and he made a profit while the retail investors who trusted him lost money.

And the reality is that Palihapitiya got away with it. He’s boastfully summering in Italy and reveling in his luxurious wedding on All-In, the podcast that he co-hosts. Elon Musk and Grimes were apparently in attendance.

The media has actually been pretty gentle toward Palihapitiya, given the epic stock depreciation of the companies he took public. Maybe it’s because outlets like CNBC played their own part in hyping up the SPAC fiasco beginning in 2020. Or maybe it’s because SPACs were such a transparent grift from the beginning. Or maybe it’s just because Palihapitiya is fairly affable and inspirational and it would be nice, in this cynical world, to retain some heroes. (In the All-In universe, David Sacks is supposed to be the mean Republican and Palihapitiya the virtuous Democrat.)

SPACs are companies designed to go public and then merge with an existing concern—that is, to allow that existing company to raise money from retail investors without much of the regulatory scrutiny that a traditional IPO requires. To me, the SPACmania was such an obvious cash grab and ego play that I couldn’t get all that upset about it when it crumbled. The writing had been on the wall from the beginning.

I profiled Palihapitiya back in November 2020, just as some of his SPACs were spinning up. I talked to him on the record for the story and titled the piece “The Man With Six SPACs.” It was obvious then that this was a game of regulatory arbitrage: SPAC sponsors believed that they could hype up companies, talk about future performance, and make money even if the target companies that they acquired fell in value. The companies that Palihapitiya was promoting were not top-tier Silicon Valley startups. Startups like Opendoor and Clover Health were risky, money-losing companies. And I wrote in that 2020 story that sponsors could make money even if the companies they backed fell in value on the public markets.

Here was the billboard quote from investor Jeremy Levine: “The SPAC thing—that is going to be a crazy bubble. It will look like the 1999 internet bubble where basically all of those companies went to zero. There will be some good ones. Most of them will be true disasters.”

We knew. People should have known.

Palihapitiya was full of hype and bombast. He compared Metromile—one of his SPAC companies, which ultimately saw its stock tank before being acquired in a fire sale—with Warren Buffett’s bet on Geico.

When Palihapitiya’s SPACs—which included Virgin Galactic, Opendoor, Clover, and SoFi —proved to be disasters and, in September 2022, he gave up on two other SPACs he had planned, I kind of shrugged my shoulders. This had been an obvious grift the whole time. It wasn’t worse than GameStop, initial coin offerings, or any number of crypto scams. If I spent all my time getting outraged about people who made money off empty hype, I would be in a constant state of fury. Plus, Palihapitiya was one of my favorite characters on my favorite business podcast.

Sure, I badgered Jason Calacanis that he and the other All-In co-hosts should give Palihapitiya a harder time about the SPAC performance on the show. But I largely decided not to dance on the grave of Palihapitiya’s lucrative SPAC escapade.

From my vantage point, Silicon Valley’s pivot to SPACmania was part of a broader abandonment of the venture capital industry’s principles by money-hungry pockets of the industry.

Venture capital was, I thought, supposed to be all about alignment of incentives—putting limited partners, venture capital firms, and founders on the same path to financial success. Everyone gets rich when a company actually works and can prove itself to the public markets.

Instead, after years of low interest rates, high private valuations, and weakening metrics, unscrupulous startup-world players identified plenty of ways to get rich off momentum on the private markets:

Founders sold private shares, netting fortunes before their companies ever turned a profit or went public. Investors flipped shares to later-stage investors, locking in wins. They raised enormous funds, reaping management fees. They split off sidecars, insulating certain deals from the overall performance of their fund. Limited partners dumped money into crossover funds who were playing a different game entirely, further distorting venture capital firms’ incentives. All this moneymaking in the private markets was creating more and more pressure to figure out a path for speculative, money-losing startups to go public. And suddenly Silicon Valley seized on the special purpose acquisition company. SPACs could take startups public while projecting all sorts of wild financial performance into the future.

It was a financial vehicle to square the circle. The unicorn hordes needed to go public to justify massive private valuations—but many companies were in no shape to do so via a traditional IPO. Public market investors valued companies based off actual financial metrics, and while they were willing to give companies high multiples during the boom times, there were limits.

But suddenly, because of an apparent hole in the financial regulations, SPACs gave startups a window where they could claim that they would generate profits five or 10 years from now—and so public market investors could credulously value companies relative to that forward-looking guidance, even though those estimates were in many cases totally outlandish.

Palihapitiya simply stepped into a world that was desperate to be told these startups were good and that there was money to be made riding the momentum train. The private markets had been doing it for years. Why should retail investors be denied their time at the roulette wheel?

And so Palihapitiya gave the world what it wanted. He pitched the companies on CNBC, retail investors poured into the companies, Palihapitiya unloaded his shares, and slowly, reality set in as the shares of the companies continued to fall.

So, like I said, he got away with it (though he is facing lawsuits).

But Palihapitiya can’t take his win at the regular person’s loss with grace.

Earlier this week, he started dunking on people on social media, proclaiming himself (not for the first time) the man “in the arena.”

Fresh off his wedding—a moment when you would hope someone would be imbued with a sense of wisdom and perspective—Palihapitiya is passing the buck, dismissing his role in convincing people to lose a bunch of money betting on the stocks that he was hawking.

Chamath! That was the trade that you were engaged in. You swapped your reputation for SPAC sponsor fees. You should have done some diligence on what you were getting yourself into. How were you underwriting the damage to your reputation?

Stop being a victim.